As a collector of jewelry, fine art, and other valuable possessions, you know it’s essential to protect your investment. According to the Department of Justice, approximately 70% of reported annual personal property thefts include jewelry.

Standard homeowner’s insurance most often does NOT cover the loss of jewelry and antiques, collectibles, electronics, silver, and artwork. Many other policies may offer limited coverage of up to $1,000 to $2,500 per item. Individuals are responsible to individually endorse and add items they want coverage for but many do not know this until it is too late. Either way, too many consumers believe their policies offer full coverage, only to find out after a theft that they cannot recoup their loss. Only by requesting this coverage will you keep your valuable heirlooms and investments safe.

High-value insurance (Also known as Personal Article Floater policies) options from Meslee Personal Insurance offer the most comprehensive policies to secure your substantial assets affordably.

What Does High-Value Insurance Cover?

Generally, any items in your home worth more than $1,000 should have additional insurance coverage. Some typical high-value items include:

- Artwork

- Jewelry

- Collectibles

- Furs

- Antiques

- Vehicles

- Firearms

- Electronic equipment

- Silver

While you sort through your high-value belongings, keep in mind that some irreplaceable items or those with sentimental value may not be insurable at the value you believe them to be worth unless special arrangements are made. Your insurance agent will help you find the best options for your list of assets.

How Jewelry Insurance Works

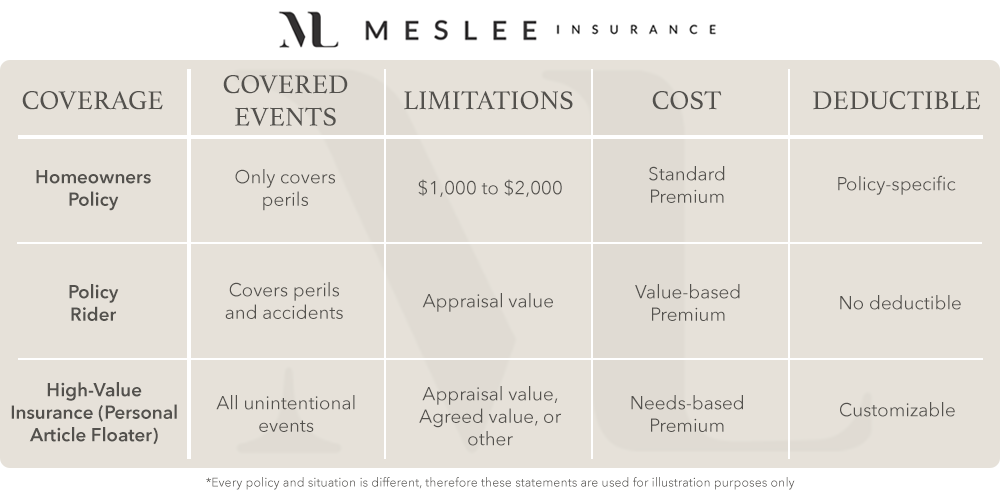

A standard homeowner’s policy typically includes jewelry coverage for $1,000 to $2,000 per item with an upper limit if there are multiple items stolen. This is true unless you specifically add and endorse individual items to your policy and pay additional premium for those items.

Additionally, most policies only cover a list of specific perils. If you misplace or accidentally lose your jewelry, your homeowner’s coverage may not offer compensation. For example, if your engagement ring falls down the drain and is damaged, coverage may not apply.

A policy rider, or endorsement, provides additional, but limited protection. For full coverage of your jewelry, you’ll need high-value insurance which is also known as a personal article floater. Below is an overview of how these policies typically compare.*

*Every policy and situation is different, therefore these statements are used for illustration purposes only

Those with one or more valuable possessions, particularly high-net-worth individuals, benefit from a high-value insurance policy’s affordable and comprehensive coverage options.

The good news is that fully customizable protection from Meslee Jewelry and Art Services can meet the needs of even the most complicated insurance cases.

Tips for Using Your High-Value Insurance

Getting the most out of your high-value insurance policy requires that you take a few preliminary measures.

The Appraisal

Your insurance agent will require an appraisal of the items you wish to insure to determine your policy coverage and premium rate. When identifying the replacement cost for the jewelry, you’ll need the following information.

- Description of the item

- List of precious metals and gemstones including details on clarity, cut, weight, carat, and other details

- Retail value, cost value or agreed value

Asking your jeweler for an appraisal upon purchase is highly recommended. However, you should establish that the appraiser has all of the relevant credentials. You can find certified appraisers through:

- National Association of Jewelry Appraisers

- American Gem Society

- Gemological Institute of America

Documents You’ll Need

The first piece of documentation you need to insure your jewelry and other valuable possessions is a descriptive receipt from the jeweler. This receipt should include an address and contact information in the official business letterhead.

You should also keep a dated photo of the item as proof of ownership. The appraiser should provide you with an official certificate confirming the value of the piece. An appraisal form in a standardized format is ideal.

The insurance agent will use these details to obtain premium rates and determine the coverage amounts. Having all the documents on hand can also significantly speed up your claim when and if you need to make one.

Valuation and Settlement Issues

Any details missing from the appraisal form will likely create issues if you file a claim. When you receive the documentation from the appraiser, you should ensure that all details are complete and correct. For example, the form should list the cut, mounting, and setting of your jewelry piece. Similarly, any discrepancies in color, shape, or size can negatively impact the valuation process and replacement cost.

Is High-Value Insurance Worth It?

High-value insurance policies provide more extensive coverage and flexibility compared to standard homeowners’ coverage as well as endorsement riders to such policies. Consequently, these policy premiums may be higher than what you’d pay for traditional coverage. However, a standard home policy isn’t designed for high-end homeowners, jewelry collectors, or others with substantial assets. In the event of a loss, traditional coverage may be insufficient to replace these valuables.

The Meslee Guarantee

At Meslee, we customize your high-value insurance to meet your unique needs. We have extensive experience designing policy plans that address the specific risk exposures of affluent individuals.

What We Insure

We insure a wide range of valuables for jewelers, art galleries, auction houses, museums, and even armored car couriers. Our expert team specializes in jewelry, fine art, and species insurance solutions that offer the highest quality results.

Why Choose Meslee

There are many advantages to choosing Meslee over larger insurance companies.

- Meslee specializes in high-value insurance that maximizes protection while keeping premiums low.

- Mesless’s customer service beats a large company’s impersonal interactions every time.

- Get approval for coverage, even if you have a history of claims or poor credit history.

- Your Meslee insurance agent will personalize a policy designed to meet your needs.

We’re dedicated to protecting the personal property of wealthy individuals with a diverse range of protective solutions.

Meslee’s Unique Insurance Options

In addition to protecting your jewelry and art, Meslee provides an extensive selection of novel, high-end insurance products.

- Coverage for High-Value Homes, including those with Brush and Coastal Exposures

- Coverage for Yachts, high-end cars, and collectible vehicles

- Personal Umbrella Coverage

- Business Insurance Coverage

Our outstanding network of carriers enables us to match clients with the best insurance policies for their risk profiles.

Final Thoughts

Standard homeowners insurance policies just don’t provide sufficient protection for high-net-worth individuals. The typical coverage limit for jewelry on a homeowner’s policy, for example, is $2,500 and often less per item, which isn’t enough to replace expensive items in the event of a loss. Additionally, these standard policies only cover personal property in the event of a covered peril, and not if your jewelry is accidentally lost or damaged. Many choose to endorse a policy to cover a specific item; however, even this coverage is more limited than a high-value insurance personal article floater policy. Moreover, these policies may work for one or two items but when insuring a collection, it is best for consumers to seek a separate policy which can offer custom solutions and more comprehensive coverage.

If you’re looking for affordable and comprehensive coverage to fully insure the value of your jewelry, fine art, and other valuables, a high-value insurance policy is the best way to protect your investment. Meslee’s experienced team of specialists can find insurance solutions to secure high-value belongings.

To learn more about High-Value Insurance Options, contact the experts at Meslee at (213) 488-1000 or leave us a message on our online form. Our insurance specialists can answer all of your questions and will get back to you within one business day.