AQUACULTURE INSURANCE

Aquaculture Insurance Exchange

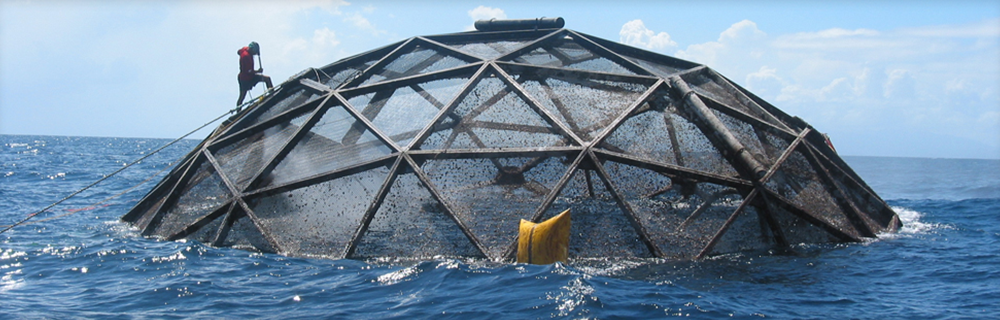

As the demand for fresh fish grows exponentially, fish farming has emerged as the predominant method to meet the need of seafood products. Given the vulnerability to major losses, and inherent lack of insurance options for the industry, we created The Aquaculture Insurance Exchange to provide reliable coverage for the booming Aquaculture industry of North America. Our mission is to protect your aquaculture establishment and the aquatic life through customized policies that cover you equipment and facilities, live fish transits and stock mortality.

At Meslee, we work together to deliver the best. Behind your primary contact is a team of skilled and dedicated specialists, who have amassed a wealth of knowledge with their years of experience. As a result, we provide seamless service, and quality results. We work closely with Megan James, an industry expert with over ten years of experience in both the non-profit and commercial aquaculture sectors. She earned a Bachelor’s degree from the University of Miami Rosenstiel School for Marine and Atmospheric Science and Master’s degree in Sustainable Aquaculture at the University of Stirling. She works closely with our team to source and create comprehensive policies at competitive pricing, and consults directly with clients, to ensure their needs are met.

INDEMNITY-BASED STOCK MORTALITY INSURANCE

Indemnity-based stock mortality insurance is a risk transfer solution available to farmers who operate with recorded stock control procedures, irrespective of species or environment.

These types of policies are primarily written on a “Named Peril” or “All Risk” basis that provides a list of potential perils, from which a client can decide the breadth of cover he feels is appropriate to his particular circumstance.

We can specifically tailor cover to suit the requirements of both the insured and the reinsured dependent upon their individual circumstances.

Offshore Perils

- Storm, lightning, tsunami, collision, sudden and unforeseen structural failure of equipment.

- Theft and malicious acts.

- Predation or physical damage caused by predators or other aquatic organisms.

- Freezing and ice damage.

- Pollution, suffocation due to plankton bloom or other competing biological activity or to changes in the physical or chemical conditions of the water, high water temperature.

- Any other change in concentration of the normal chemical constituents of the water, including change in pH or salinity.

- Disease.

ONSHORE PERILS

- Pollution.

- Malicious acts, theft and predators.

- Flood, tsunami.

- Storm damage, subsidence, landslip, structural failure, breakage or blockage of any part of the water supply system.

- Drought, fire, lightning, explosion, earthquake.

- Freezing, frost damage.

- Mechanical or electrical breakdown or accidental damage to machinery and other installations, failure or interruption of the electricity supply, electrocution.

- Suffocation due to vegetation, competing biological activity or high water temperature

- Any other change in concentration of the normal chemical constituents of the water, including change in pH or salinity.

- Disease.

INNOVATIVE PRODUCTS

- New species and new technology – new insurance products

- Flexibility

INDEX-BASED STOCK MORTALITY INSURANCE

-

- Index-based insurance is a risk transfer solution primarily used to protect individuals or groups of individuals from the risks associated with natural perils

- The “index” is an indicator variable (e.g. windspeed, rainfall etc.) that has a close correlation with expected actual loss events and cannot be influenced by either the insured or insurer

- The policies include a predetermined payout structure based on an external indicator(s) that triggers a payment to all insured clients within a specific program or geographical area

- The premium and payout structure is based on an agreed limit of liability, which usually includes both individual and aggregate limits

- The premium is based on historic weather data taking into account predicted climate change effects

- The payout structure can be designed to include an increased payout with more extreme events

- The insureds pay a regular insurance premium and receive payouts when an index crosses an agreed trigger point

EXAMPLES OF NATURAL PERILS THAT ARE WEATHER OR CLIMATE RELATED AND SUITABLE FOR INDEX-BASED COVER

-

- Windstorm/hurricane

- Rainfall – too much or too little (flood or drought)

- Temperature – too high or too low

- Wave height

- Currents

- Plankton bloom

- Some aspects of water pollution

- Productivity/forage availability

The above range of perils is not exhaustive and will continue to expand as technology advances.

Some advantages of index-based insurance solutions

- Little information required from the insured

- Easily understood principles for the insured

- Ease of operation, once set up, for both the insured and insurers

- Ease and speed of loss adjusting/settlement

- Greatly reduced moral hazard

- Reduced adverse selection

- Well-suited for subsidized programs and public-private partnerships

INDEX-BASED STOCK MORTALITY INSURANCE

Index-based insurance is a risk transfer solution primarily used to protect individuals or groups of individuals from the risks associated with weather fluctuations.

- • Identify the specific natural peril(s) that constitute the significant risk

- • Determine the “trigger points” that correlate to actual losses suffered

- • Determine the appropriate financial indemnity

- • Develop a specific index based upon the above

• Analyse historical weather/climate data to determine the frequency/probability of “trigger events” in order to calculate the premium, limits of liability, etc.

ASSOCIATED COVER

In addition to the above, we can arrange cover for risks associated with aquaculture and livestock operations.

Examples of Associated Cover

-

- Livestock – in situ cover for traditional farmed species as well as exotic and aquatic species

- Live Transport – transit cover for traditional farmed species as well as exotic and aquatic species

- Agriculture – index-based solutions for terrestrial and aquatic/marine crops

- Post-harvest Cargo

- Product Recall/Liability

- Marine Equipment associated with offshore fish farming

- Marine Liabilities associated with offshore fish farming

- Workboats and Small Vessels – H&M, P&I etc.

- Business Interruption

RISK MANAGEMENT

Our expert team has experience across a wide spectrum of the aquaculture industry. Collectively our team has amassed a wealth of knowledge, having earned degrees in Marine Science, Atmospheric Science and Biology, and developing their skill set consulting and working with numerous companies and groups across North America. Our team’s experience ranges from collaboration with small, family owned and operated production facilities, to working with one of the largest land based recirculating facilities in the world.

At Meslee Insurance Services, we strive to make an impact by finding the key to helping the industry grow through risk management and protection of facilities and stocks. Contact us, and together we can create the solution you need to help your business thrive.

CONTACT US

Headquarters

7164 Melrose Ave,

Los Angeles, CA 90046

2325 Palos Verdes Drive West, Suite 204, Palos Verdes Estates, Ca 90274

550 S. Hill Street Suite 1554,

Los Angeles, CA 90013

(213) 488-1000

info@meslee.com

(213) 488-1141